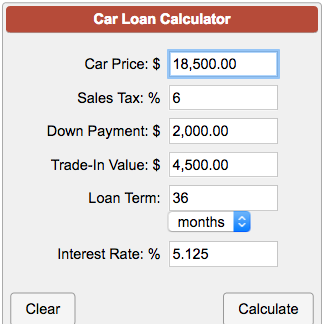

You also have a car – an old Chevrolet Silverado, worth about $7,000, and $1,500 on your saving account. Now we know the formula used in the car loan payment, we can try to perform a sample calculation.įirstly, let's assume that you want to buy a five-year-old Jeep Wrangler which is worth $20,000. Usually, it is more profitable to by a new car with dealership financing, as it is significantly cheaper – interest rates in such loans can be as low as 0.5%, 1% or 1.5%. Note that to promote sales, car manufacturers offer attractive financing opportunities via dealers. In dealership financing you usually cannot choose the lending institution – usually the loan is granted by so-called captive lenders who are associated with a car manufacturer. In dealership financing, it is a car dealer who initiates the process of taking a loan and do all necessary paperwork.You sign a purchase contract with a car dealer and then use the money borrowed from the direct lender to make the appropriate payments. Direct lending has a form of typical loan taken from a bank or credit union.When considering taking a car loan for buying a new car, it is worth knowing that there are two main types of financing on a car loan: direct lending or dealership financing. The general rule of a thumb says that the smaller amount you borrow, the higher the interest rate is. The interest rate is typically constant over the whole lending period and depends on how much you are borrowing. After the purchase, you have to repay it in fixed monthly payments, usually over one to five years (12 – 60 months). In the simplest case, it is the price of the car minus the money you have.Ī car loan allows you to borrow the fixed sum of money you need to buy the vehicle. Basing the calculations on that price you should be able to work out the amount you need to borrow. Once you find the car you want to buy, you usually know its price. Another difference is the payback period length: in the case of mortgages it could be as long as 30 years, the typical term of a car loan is between 12 to 60 months. Also, the loan granting process is less complicated and shorter in the case of auto loans. So, if you are not able to pay the installments and as a consequence are unable pay back the borrowed money, the car is legally repossessed to the lender.Ĭar loans differ from a mortgage because you do not need any real estate collateral to apply for it. Another difference is that car loans have a built-in collateral - the purchased car. The main difference between the standard short-term loan and an auto loan is its purpose – in case of an auto loan, it is strictly defined. Once you take a loan, you have to make a repayment each month on the principal and the interest. It works like any other secured loan granted by a financial institution. The auto loan (or car loan) is a type of a short-term personal loan, used for purchasing a car. If you are shopping around for car loans, you may check our loan comparison calculator, which can give you excellent support in choosing the most favorable option. If you're considering buying a recreational vehicle, check our RV loan calculator.

#Auto loan finance calculator how to

We will also explain to you step by step how to calculate the monthly payments on any car loan and how to take into account sales tax. What are the main pros and cons of taking an auto loan?.How does the auto loan calculator work?.How to use the auto loan payment calculator?.

What is the formula for calculating payments on a car loan?.Note that you can use our tool either as a used car loan calculator or as a brand new car loan calculator, changing between these two by clicking the advanced mode button below the auto loan calculator.

Moreover, thanks to this car loan payment calculator you will be able to decide whether you can afford to take that particular loan. Our car loan calculator will also help you work out what will be the best loan deal for you. If you want to buy a new car and are considering taking a loan, this auto loan calculator will help you estimate the cost of borrowing.

0 kommentar(er)

0 kommentar(er)